The ability to get your IRS audits done in the best ways possible is a good thing. A lot of times, people often get stuck when trying to calculate their taxes leaving them in a loophole of debt that they may find difficult to come out from.

This is where the online calculators come into play. They are very handy and at all times, they give the best results that beat your imagination. Know more from OnlineCalculators.

Having accurate IRS calculations is important to avoid tax evasion. You may likely get arrested if you do not get your taxes right as an individual. These online calculators get rid of all the hassles for you.

It is important to note that these online calculators are mostly applied to only individual IRS payments and not corporate taxes. So, it is often very difficult to calculate corporate taxes with this software.

Why you need this IRS interest calculator software.

- It is free.

This is one of the things that makes people love using this online calculator. You get your IRS details calculated at no extra cost.

- It is reliable

Most people are often confused about the liability of the software. They are often led to think that since it is online free software, it will not be reliable. This is wrong. The line calculator software onlinecalculator.cc is one of the most reliable software that you can find. Try it.

How does it work?

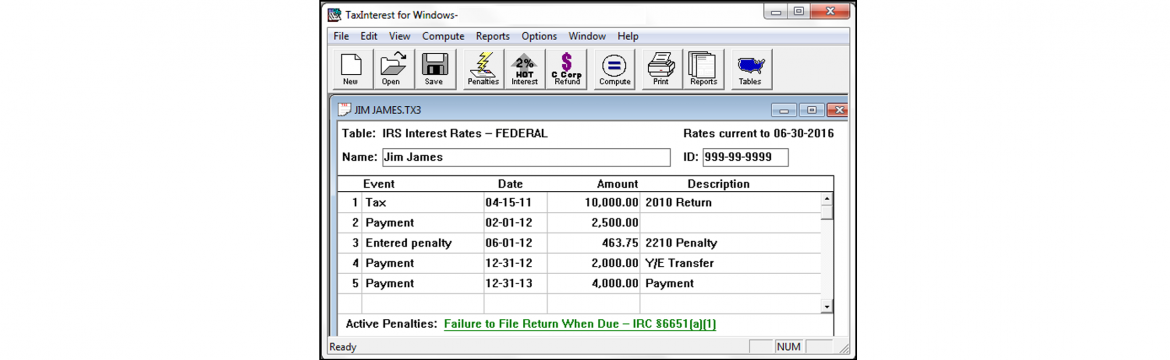

All you need to do to start using this IRS Calculator is to select a due date from the drop-down options. Typically, the set due date on the software is April 15th but you can always choose any date you want or you plan on paying your taxes.

Select the payment date from the drop-down options and select the amount you owe. This process is very easy and seamless.

Click on the Calculate button to calculate your results for the IRS rate and the total amount which you are required to pay.

It looks very easy, right? It is.

When you follow these steps very well, you will see that you’ll begin to get the kind of results you require.

While you are calculating your IRS interest rate, you must know that interest rates also change over time depending on the time of the year. So, during your entire calculation, you are required to take note of the rates given to you by the IRS.

Another thing you need to note is that your penalty charges are not also calculated with this payment. So, if you have any outstanding penalties, you won’t be able to calculate it with this online calculator.

CONCLUSION.

Nevertheless, the entire online calculator software is very seamless and it is built to give you the best results at any time. It is one of the highly recommended online calculators for individuals seeking simple ways to get their IRS interests done.